How to Register for an ABN in Australia

What Is an ABN?

An ABN (Australian Business Number) is an 11-digit number that identifies your business. You need it to:

Get paid as a contractor or freelancer

Issue invoices

Work on platforms like Taskoon

Deal with the ATO and other government agencies

Who Needs an ABN?

You should apply for an ABN if you:

Work independently or provide services

Earn income outside PAYG employment

Operate as a sole trader or small business

Want to onboard as a Tasker or Business on Taskoon

What You Need Before Applying

Have these ready:

Tax File Number (TFN)

Australian address

Valid ID (licence or passport)

Description of your services (e.g. cleaning, driving, labour support)

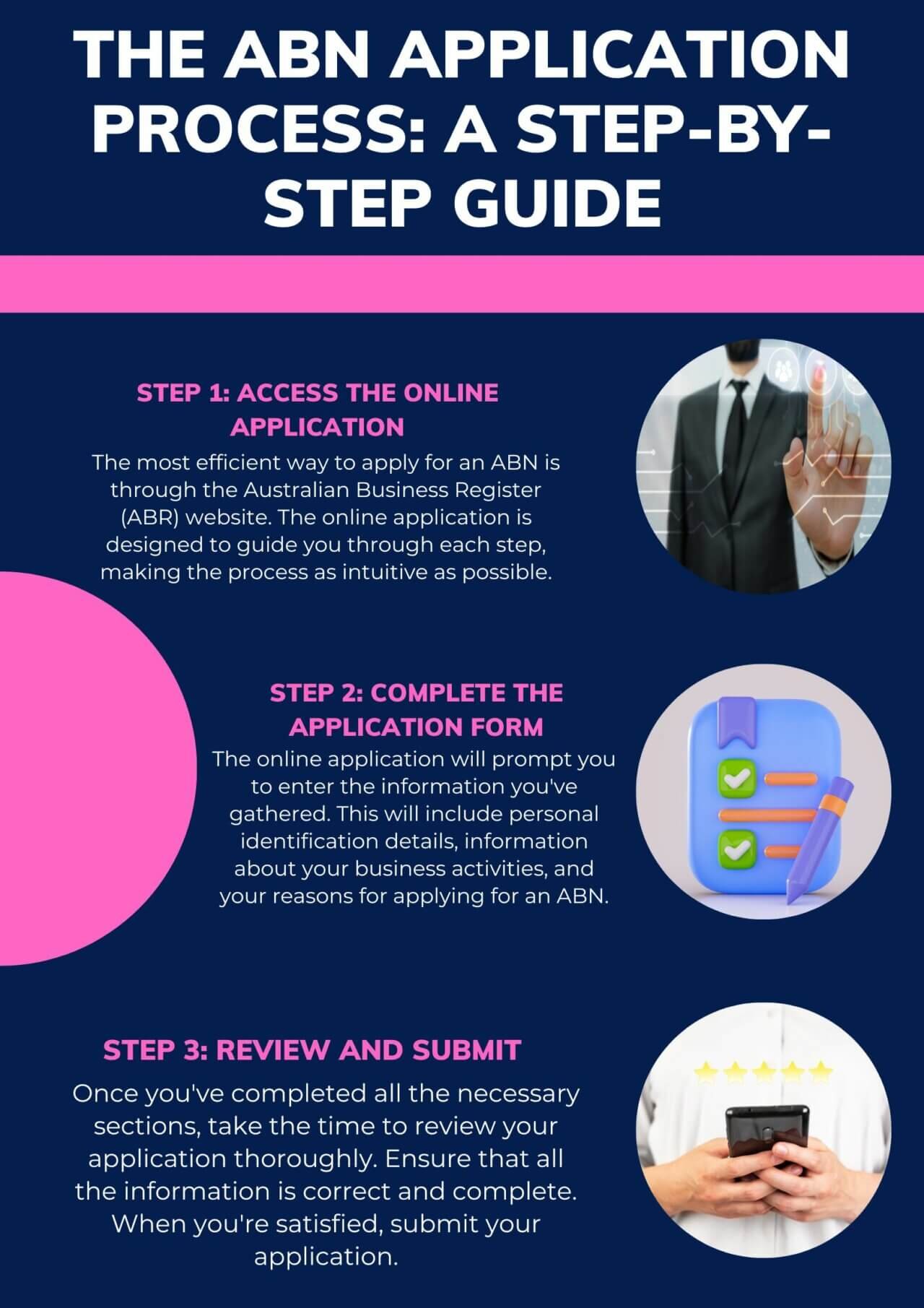

How to Apply for an ABN (Step-by-Step)

1. Apply on the Official Website

Register for free at 👉 https://www.abr.gov.au

2. Choose Your Business Type

Most Taskers select Sole Trader.

3. Enter Your Details

Please provide your TFN, personal details, and information about your business activities.

4. Submit Your Application

Many ABNs are issued instantly. Some take up to 28 days.

Do You Need to Register for GST?

Mandatory if turnover exceeds $75,000/year

On Taskoon, it’s mandatory as we deal with businesses and they pay GST, which they will claim.

On Taskoon, all invoices are GST-inclusive.

Why Taskoon Requires an ABN

Your ABN is used to:

Complete onboarding

Process secure payments

Generate compliant invoices

Meet Australian tax requirements

Final Thoughts

Registering for an ABN is a straightforward yet crucial step for working independently in Australia. It’s fast, free, and unlocks access to opportunities on Taskoon. If you work as a Tasker, freelancer, or independent contractor, registering for an Australian Business Number (ABN) offers more than just compliance; it unlocks real financial and professional advantages.

Common Mistakes to Avoid

❌ Applying through paid third-party websites

❌ Using incorrect business activity descriptions

❌ Not updating details if your situation changes

❌ Assuming an ABN is optional for contracting work